Arctic Feed offers exponential opportunities to investors, with a first-mover advantage, in a growth market

As the global population increases its demand for healthy and sustainable proteins, global aquaculture continues an upward trend of steady growth. However, these trends have created an increase in the feed conversion rate (and decrease in fish growth and mortality), as the aquaculture feed companies move from marine wild-caught feed-ingredient to alternative, more sustainable ingredient sources. This has created a considerable market potential for micro-ingredients, both nationally and internationally.

The addition of new micro-ingredients into aquaculture feed, helps farmers reverse these downward trends and create unprecedented new feed conversion rates. Micro-ingredient blends are also reducing mortality rates and improving fish quality, creating access to new profitability.

Great potential for new micro-ingredients

Numerous micro-ingredients developed for terrestrial animals also work for fish. There is a big transfer potential for all aquaculture species.

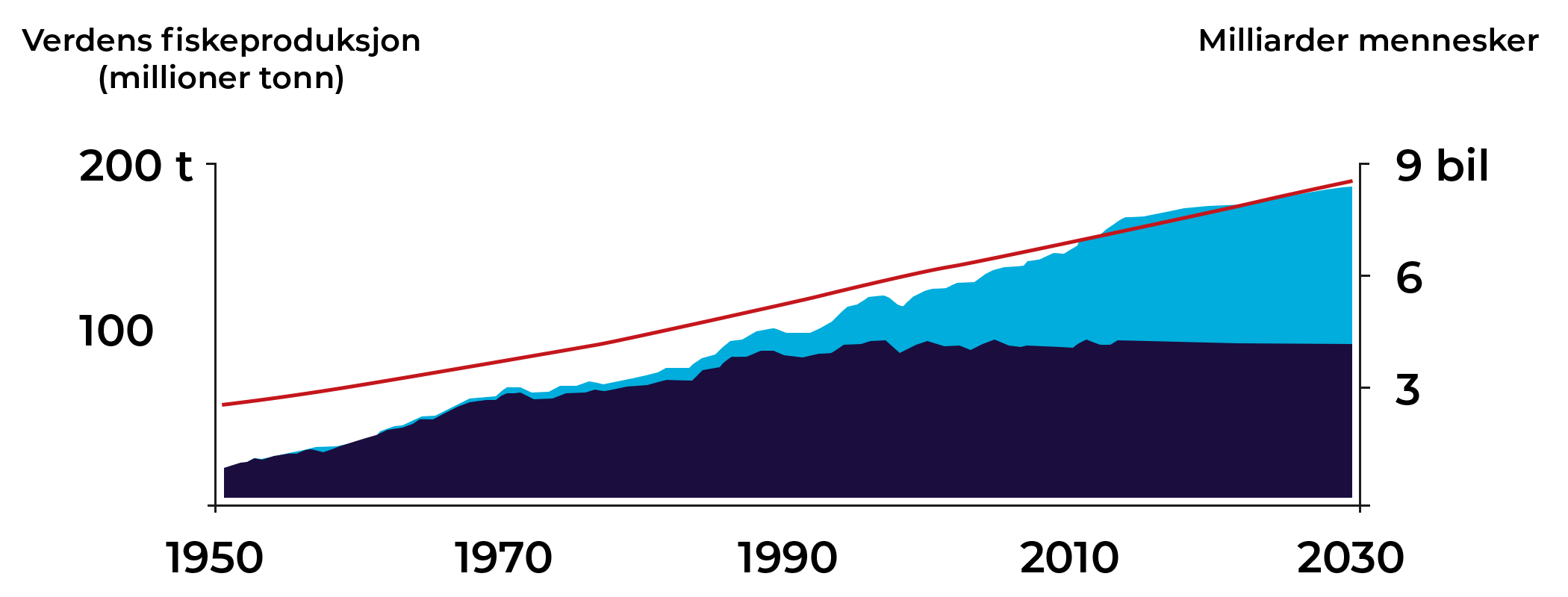

Growth in global

aquaculture

Population growth and stagnation in land-based food production will increase the demand for food from aquatic species.

Competent entrepreneurs

with extensive experience

Entrepreneurs with over 90 years of overall experience, competence and networking in global aquaculture.

Established

corporate agreements

Arctic Feed has entered into mutually binding agreements with R&D institutions, producers of micro-ingredients and an advisory board. The total portfolio of agreements represents a competitive advantage.

First movers

Arctic Feed is the first to establish a unique and proprietary product range of micro-ingredients for various aquatic species.

Norwegian Leadership

Norway has international competitiveness in industrial aquaculture. Arctic Feed is part of the Norwegian and international aquaculture community.

Premix and Trademark

Arctic Feed documents and manufactures separate mixtures (premix) of micro-ingredients sold under their trademarks. Branded premixes are difficult for competitors to copy.

Exit opportunities

Arctic Feed will be an attractive acquisition candidate for

PE funds and/or feed companies. This provides exit possibilities with profit for existing shareholders.

Arctic Feed continuously tests new product candidates in cooperation with selected R&D partners based on Arctic Feed’s protocols. This gives Arctic Feed a competitive advantage in terms of continuously launching new micro-ingredients for the improvement of animal welfare and profitability.

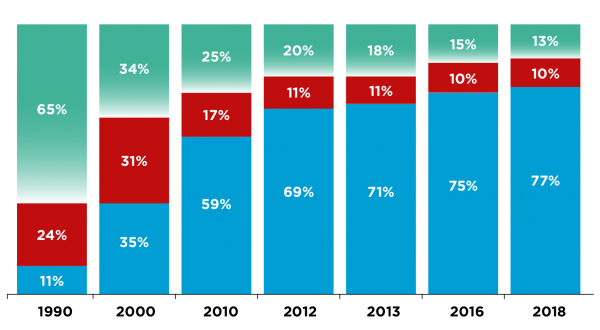

In recent years, global aquaculture has been increasing the use of plant protein in feed. This trend has focused on the use of alternative raw materials in fish feeds to reduce the exploitation of wild-caught fish.

From 2003 to 2018, the average size per fish of lost or dead fish has increased from approximately 0.3 kg to about 2.2 kg. This represents a total loss for the Norwegian salmon industry of NOK 6.5 billion per year.

Arctic Feed has demonstrated that the negative effects of the use of alternative raw materials can be reversed by the inclusion of documented micro-ingredients in the aquaculture feed.

Marine raw materials decreased from 89% to 27% between 1990 and 2018

Source: MOWI and Nofima, Veramis based on NIFES, Sprague, M et al

Arctic Feed has identified that a large number of proven micro-ingredients, from the agriculture sector, have the potential to provide growth and health benefits to global aquaculture.

There is a significant difference in size between the two sectors which means that the knowledge of the land-based feed industry (1,000m tonnes) is considerably more extensive than in the aquaculture feed industry (40m tonnes of feed for aquaculture of which 4m for salmon fish). This knowledge-base provides a large potential for the introduction of existing micro-ingredients from agriculture into aquaculture. Our solution is to test micro-ingredients developed for terrestrial animals and develop those micro-ingredients that provide health and growth benefits to fish.

By independently testing and verifying these ingredients, and marketing their benefits to the global aquaculture industry, we will introduce new health and growth benefits to the sector; and further profitability.

Arctic Feed operates in a growing market for aquaculture feed ingredients.

Aquaculture feed suppliers, especially in the Norwegian salmon farming sector, are turning to new ingredients as a means to combat margin erosion and decreasing yield from harvest (related to mortalities and feed conversion rates). Internationally, however, market opportunities are is considerably greater than in Norway.

Aquaculture continues to grow as an industry in order to satisfy the global demand for healthy and sustainable protein source for humans.

Growth has been created in land-based aquaculture investment (recirculating aquaculture systems for salmon) and also in the growing economies like Latin-America (shrimp), Europe (sea bass and sea bream), Africa (tilapia) and Asia (shrimp), who have identified the potential of aquaculture to efficiently feed their growing populations.

Wild fish stocks will not grow: according to FAO 60% of the world’s marine stocks are either fully exploited or overfished (FAO, 2012).

We are dedicated aquaculture veterans with a combined total of 90 years of experience, competency and relationship in the global aquaculture sector.

This expertise and our established relationships are central to our ability to collaborate effectivity across the aquaculture value chain and satisfy customer needs.

Drawing upon a vast national and international network, we are positioned with a “first-mover advantage” in our niece sector and well prepared to service global customers.